Getting My Feie Calculator To Work

Wiki Article

Not known Details About Feie Calculator

Table of ContentsA Biased View of Feie Calculator7 Easy Facts About Feie Calculator ShownGetting My Feie Calculator To WorkFeie Calculator Fundamentals ExplainedThe Ultimate Guide To Feie Calculator

He offered his U.S. home to establish his intent to live abroad permanently and used for a Mexican residency visa with his other half to assist accomplish the Bona Fide Residency Examination. Neil points out that getting building abroad can be testing without initial experiencing the place."It's something that individuals need to be actually persistent regarding," he says, and suggests expats to be mindful of common errors, such as overstaying in the United state

Neil is careful to mindful to Stress and anxiety tax authorities that "I'm not conducting any carrying out any kind of Organization. The U.S. is one of the couple of nations that taxes its citizens no matter of where they live, indicating that also if a deportee has no earnings from United state

tax returnTax obligation "The Foreign Tax Credit enables people functioning in high-tax countries like the UK to offset their United state tax obligation liability by the quantity they have actually already paid in tax obligations abroad," says Lewis.

The Greatest Guide To Feie Calculator

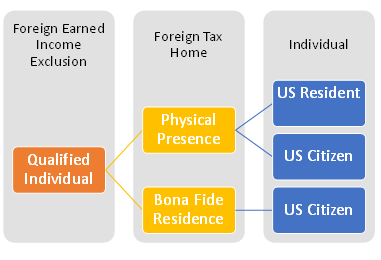

Below are several of one of the most frequently asked inquiries about the FEIE and other exemptions The Foreign Earned Earnings Exclusion (FEIE) permits united state taxpayers to exclude as much as $130,000 of foreign-earned revenue from federal revenue tax, reducing their U.S. tax obligation liability. To get FEIE, you need to fulfill either the Physical Existence Examination (330 days abroad) or the Authentic Residence Test (confirm your key home in an international nation for a whole tax obligation year).

The Physical Presence Test additionally needs United state taxpayers to have both a foreign revenue and an international tax home.

Our Feie Calculator PDFs

A revenue tax treaty in between the united state and another nation can aid prevent dual taxation. While the Foreign Earned Earnings Exclusion reduces gross income, a treaty might give fringe benefits for eligible taxpayers abroad. FBAR (Foreign Savings Account Record) is a called for filing for united state people with over $10,000 in foreign monetary accounts.Qualification for FEIE relies on conference particular residency or physical existence tests. is a tax expert on the Harness platform and the owner of Chessis Tax. He belongs pop over to this site to the National Association of Enrolled Representatives, the Texas Culture of Enrolled Professionals, and the Texas Society of CPAs. He brings over a decade of experience helping Large 4 companies, recommending expatriates and high-net-worth individuals.

Neil Johnson, CPA, is a tax expert on the Harness platform and the creator of The Tax Dude. He has more than thirty years of experience and now focuses on CFO solutions, equity compensation, copyright tax, marijuana taxes and divorce relevant tax/financial planning issues. He is an expat based in Mexico - https://slides.com/feiecalcu.

The foreign made earnings exemptions, occasionally described as the Sec. 911 exclusions, leave out tax obligation on salaries gained from functioning abroad. The exclusions comprise 2 parts - a revenue exclusion and a housing exclusion. The complying with Frequently asked questions talk about the advantage of the exclusions including when both partners are expats in a basic manner.

Feie Calculator Fundamentals Explained

The tax obligation advantage excludes the revenue from tax at lower tax rates. Formerly, the exclusions "came off the top" minimizing earnings topic to tax at the leading tax rates.These exemptions do not excuse the salaries from US tax however merely supply a tax reduction. Keep in mind that a bachelor working abroad for every one of 2025 who made concerning $145,000 with no various other income will certainly have taxed earnings decreased to no - efficiently the very same response as being "tax complimentary." The exemptions are calculated every day.

Report this wiki page